The economy is steadily improving, but North Carolina’s public universities could still face lean times when the legislature convenes in January.

The Office of the State Controller estimates that state revenue for the first five months of the fiscal year is down $410 million from the same period last year — a drop of 5%. Almost half-way through the fiscal year, revenues are $190 million less than state legislators predicted when they adopted the 2014-15 budget in July.

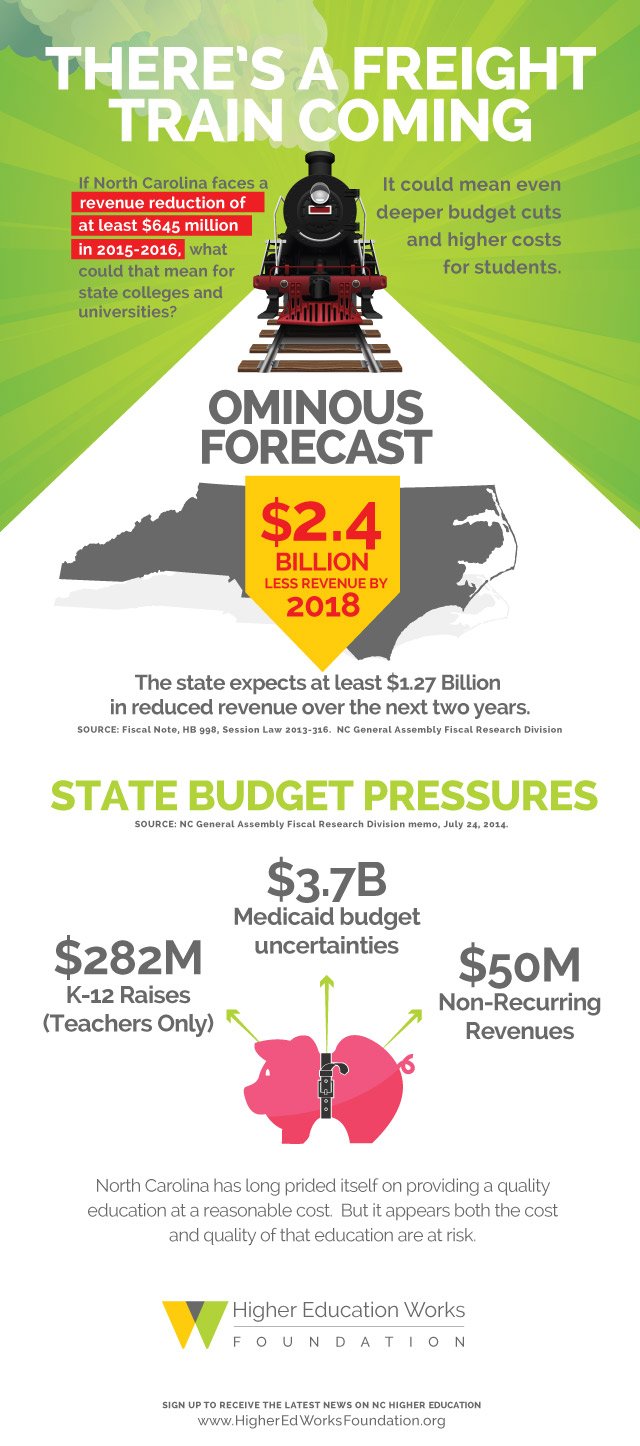

The picture doesn’t improve in the coming years – the tax cuts state legislators approved in 2013 were projected at the time to reduce state revenues by more than $2.4 billion over five years.[1] More recent adjustments have reduced projected revenue from the state income tax further, by $150-200 million a year through 2018.[2]

That could be bad news for North Carolina students and families. The shortfall could well mean less critical state investment in higher education — and even greater reliance on tuition and fee hikes.

State support is what keeps tuition low. And smart investments in university research and workforce training help strengthen state and regional economies.

That’s why most states have chosen to reinvest in higher education over the past year. Public colleges and universities across the country suffered major budget cuts during the recession, so it makes sense they’d see a rebound as the economy improves.

Left behind?

For North Carolina’s colleges and universities, however, the recession never ended. Funding to support students isn’t rebounding in North Carolina.

With higher education funding stagnant, universities across the state are proposing tuition increases to maintain educational quality.[3]

“Driven by repeated slashes in state funding by the legislature, the cost of an education in the UNC system has been rising quickly,” the Raleigh News & Observer reported in its coverage of a proposed tuition increase at NC State University.

In fact, average tuition and fees for students across the system has already risen 86% in 10 years.[4] With budget gaps growing in Raleigh, lawmakers are forcing students and their families to pick up the tab.

[1] Fiscal Note, HB 998, 2013 Session. N.C. General Assembly Fiscal Research Division. Net projected reduction in state revenues from changes in Personal Income, Corporate Income, Sales and Estate Tax: $86.6 million in 2013-14; $437.8 million in 2014-15; $644.6 million in 2015-16; $623.5 million in 2016-17; and $649.8 million in 2017-18.

[2] Brian Slivka and Barry Boardman, N.C. General Assembly Fiscal Research Division, “Updated Personal Income Tax Projections,” July 24, 2014.

[3] Wilmington: http://www.starnewsonline.com/article/20141130/ARTICLES/141139985/1108?Title=Editorial-Rising-cost-of-higher-education-is-pricing-some-N-C-students-out-of-system; Greensboro: http://www.news-record.com/news/uncg-trustees-back-rise-in-tuition/article_2416ab14-7cfd-11e4-82fc-2378af1c1aec.html

Leave a Reply